CREALOGIX recently collaborated with Compeer, the leading City of London specialist research group on an extensive survey of 500 HNWIs to find out their perception of the service they have received this year. The results show that while investors have largely the same priorities, the provision of digital wealth services to support the in-person support has increased in importance this year.

Bespoke service matters

HNWIs (high-net-worth individuals) rates the performance of investments as the most significant factor when considering their satisfaction with their wealth management provider, but the level of bespoke service was a close second. What may have shifted during the pandemic is the perception of digital wealth services playing an integral role in the provision of personalised services. Nearly half of all HNWIs stated that the client portal, mobile app and client reporting all needed improvement. The research showed that an even higher proportion of investors under 40 rated digital services as areas for improvement and 28% of all investors felt that the provision of digital services was below, or far below, their expectations during the pandemic.

Digital wealth services offer new ways to connect with clients

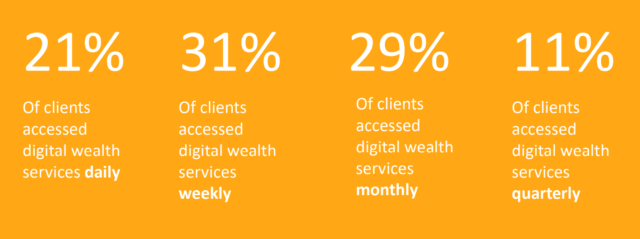

Over half of all investors access digital wealth services daily or weekly – that’s between 52 and 365 opportunities to offer value to clients every year.

However, less than half of all HNWIs found digital services easy to use, which suggests that improvements in this area could boost client engagement and satisfaction. As more of the world has become virtual in 2020, 19% of investors were ambivalent or dissatisfied with the range of available features in their digital wealth services.

What happens next?

61% of survey respondents confirmed that the availability of digital wealth services had increased in importance in 2020. A closer look at the levels of dissatisfaction and the features HNWIs use most frequently may provide some indication of the direction for future development. Over half of all investors used digital wealth services for live statements and performance reports and self-service and client nurturing opportunities were also popular with 47% logging on to specify portfolio or investments preferences and 46% viewing potentially relevant investment opportunities. Only 8% stated that they preferred face to face meetings and paper reports, which suggests that digital transformation is set to be a key priority for 2021.

Download the full report to find out how HNWIs view digital wealth services.