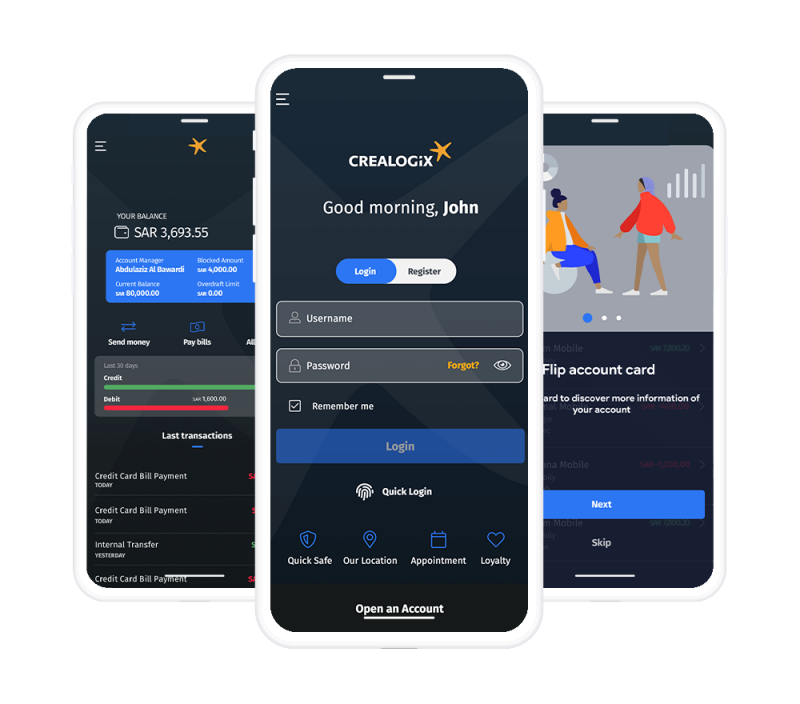

We empower financial institutions to shine in a digital world

CREALOGIX is a Swiss-based software company that specializes in digital banking and wealth management solutions.

We offer a range of services aimed at helping financial organizations enhance their customer experience and provide innovative digital solutions for their clients –

for more than 25 years.

Driving customer success

At CREALOGIX, we focus on creating digital leaders. From starting the company in Switzerland 25 years ago, we have grown to more than 380 digital experts serving many customers globally. Through our experience, innovative technology and third-party provider network, we empower financial institutions to build valuable digital relationships with their customers and clients.

Our customers