Personal, intelligent and engaging

CREALOGIX Conversational AI delivers next-generation customer interaction for financial institutions

Customer retention in the

digital age

Today, customers want to interact with financial institutions anytime, anywhere and via the channel(s) of their choice. They expect the same simplified digital interaction with financial institutions that they are used to with their other daily communications. Due to the Covid-19 pandemic, call volumes have increased, customers are visiting bank branches less frequently and more customers are turning to online services for convenience. Therefore, it is important for financial institutions to have personalised and fully integrated communications channels in place to keep customers fully engaged.

CREALOGIX Conversational AI is the solution.

Daniel Scheiber

Achieve your goals with CREALOGIX Conversational AI

Improve engagement, drive growth

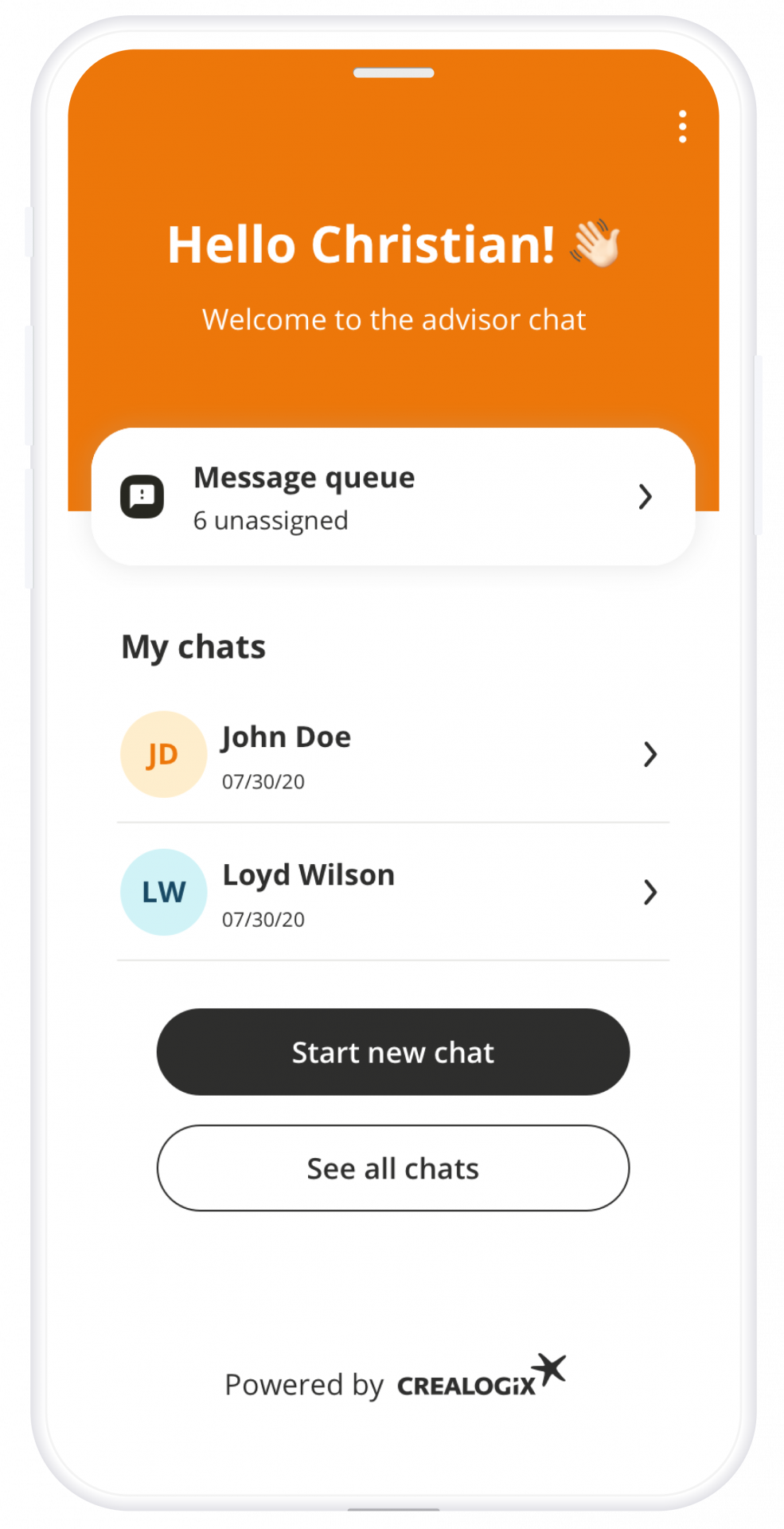

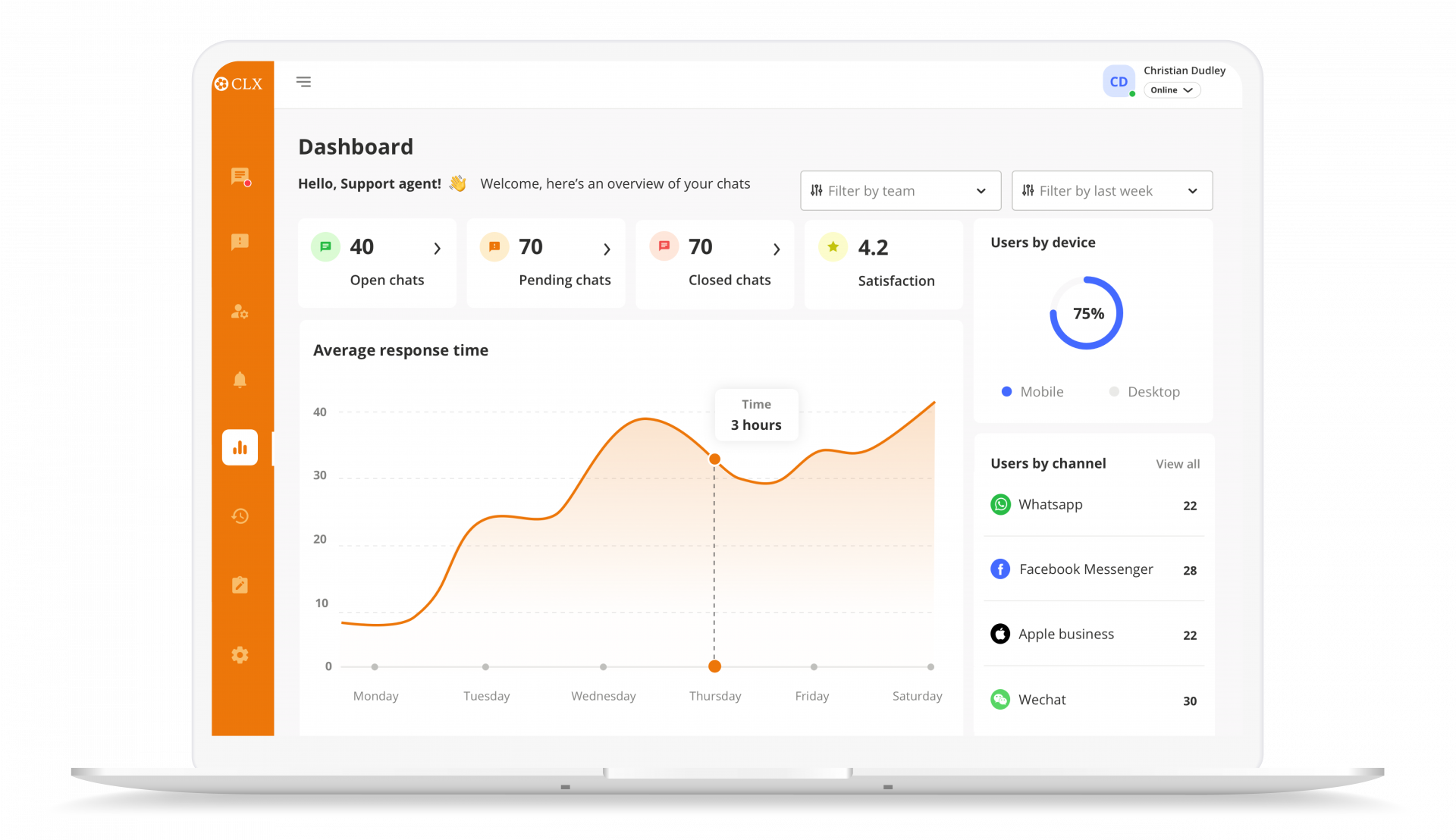

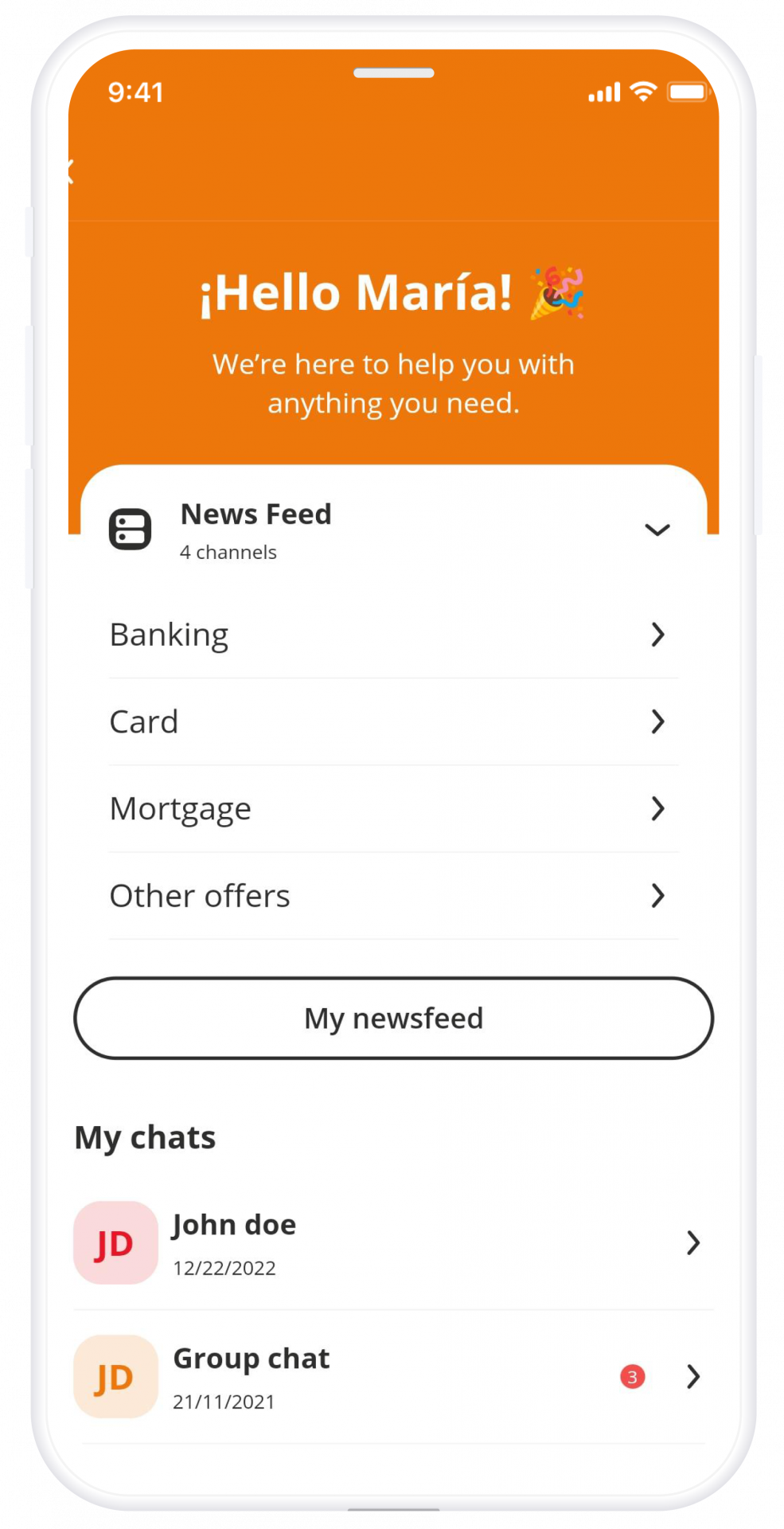

CREALOGIX Conversational AI combines the power of artificial intelligence and automation with next-generation digital personalised customer communications. Our scalable solution encompasses simple chat conversations to complex process-handling via AI-based personal virtual assistants.

By integrating and leveraging these capabilities in a seamless and complementary way, customers and prospects can easier interact with financial institutions. CREALOGIX Conversational AI enables smart, real-time customer interactions that lead to better engagement, new levels of efficiency and increased revenue opportunities that really drive growth.

Enhanced customer interactions with AI

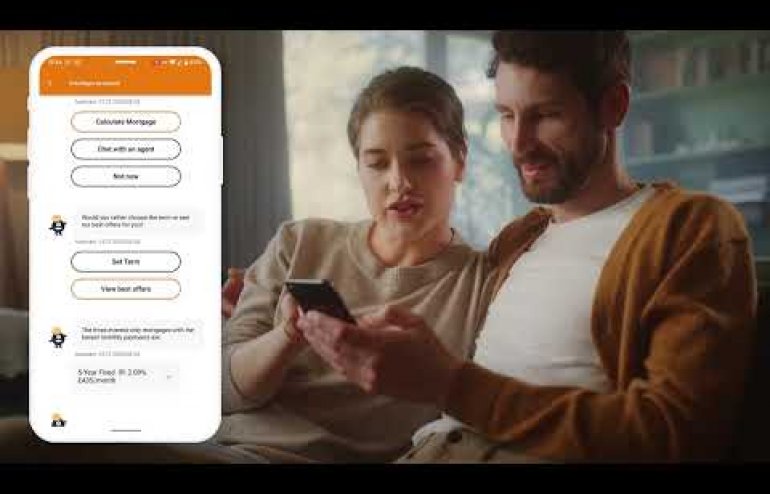

CREALOGIX Conversational AI enables financial institutions to implement smarter and more insightful real-time customer interactions. There are benefits on both sides: customers receive answers to their queries faster, whilst financial institutions can find out from every customer conversation how to enhance the services they provide.

Our Assistant provides customers with fast, consistent and accurate answers across any application, device or channel. Using Artificial Intelligence, the Assistant learns from customer conversations, improving its ability to resolve issues quickly, removing the frustration of long wait times, tedious searches and unhelpful chatbots.

CREALOGIX Conversational AI – the key benefits

How financial institutions can benefit from Conversational AI’s capabilities to open up and enhance customer interactions.

-

Digital dialogue: enable a multi-channel

approach to digitally engage with customers -

Secure: ensure secure and compliant

messaging when interacting with customers -

Relationship: enable two-way dialogue

that reinforces customer-advisor relationships -

Campaigns: execute personalised campaigns

digitally via different channels

Useful resources

![]()

Video

Discover the newest Conversational AI use case: the Wealth Concierge. Watch our presentation at the IBM Data & AI Forum. Only available in German.

Watch video![]()

Use Case (Wealth)

Find out how you can offer more personalised and intelligent experiences to your wealth clients with CREALOGIX Conversational Banking AI.

Download use case![]()

Use Case (SME)

Learn more on how you can benefit from our Conversational solution to scale services and sales in SME Banking.

Download use case![]()

E-book

Discover the six vital success factors for financial institutions looking to strategically integrate messaging into their digital offering.

Download e-book![]()

Factsheet

Learn more about CREALOGIX Conversational AI and its capabilities in the factsheet.

Download factsheetOur customers