The new rules regarding investments that account for Environmental, Social and Governance (ESG) conerns the latest requirements from MiFID II (EU Markets in Financial Instruments Directive), but compliance doesn’t have to mean more red tape. The right digital solution isn’t just a tick in the box or a way to avoid further administrative burden – it can enable an increase in client engagement and loyalty and deliver long-term growth.

What are the new rules?

From March 2021, clients must have the opportunity to express their preferences in relation to ESG issues and wealth management firms must demonstrate these have been addressed the same way as other suitability criteria. The requirement goes beyond asking the question – firms must demonstrate that they have taken sufficient care and have adequate processes in place to deliver against client goals and preferences.

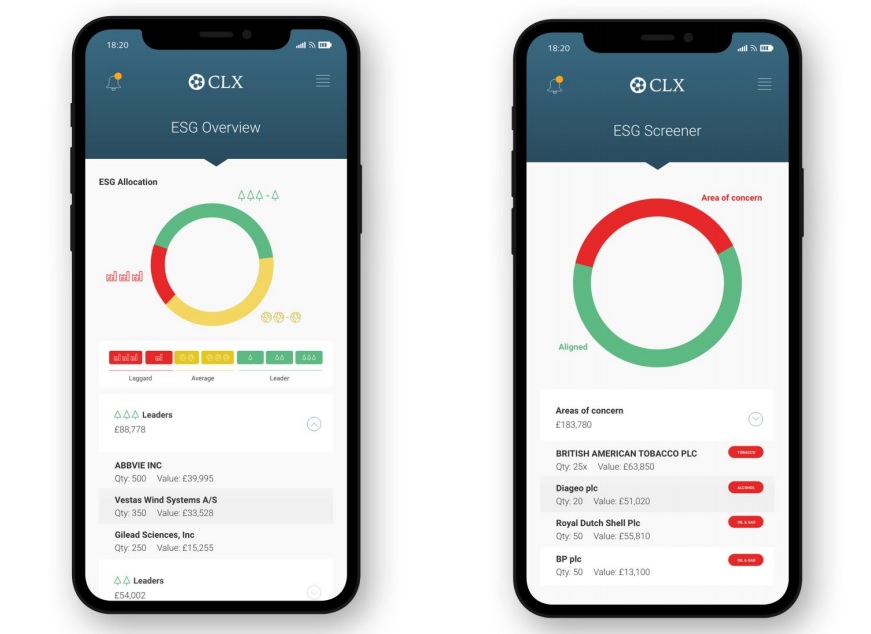

In addition, reports must be provided in relation to these criteria. If, for example, the client expresses a strong preference for investing in companies with positive environmental outcomes and/or a low carbon footprint, then the performance of the portfolio must be assessed against these preferences.

Where do we start?

Whether you already have a clear system in place for honouring clients’ ESG preferences, or you’re currently exploring the opportunity, a good place to start is the Investment Association’s Responsible Investment Framework. This not only explains key terms but looks at different components of ESG investment and how these may be categorised. This will help to define the firm’s own proposition, the choices presented to clients and whether this will be integrated into the centralised investment proposition (CIP), or provided as a specialist service. Once you’re clear on your proposition and you’ve created a standardised way to collect data, you can start communicating to clients ahead of that March deadline – and possibly ahead of your competitors.

Digital client communication can broaden the conversation around ESG

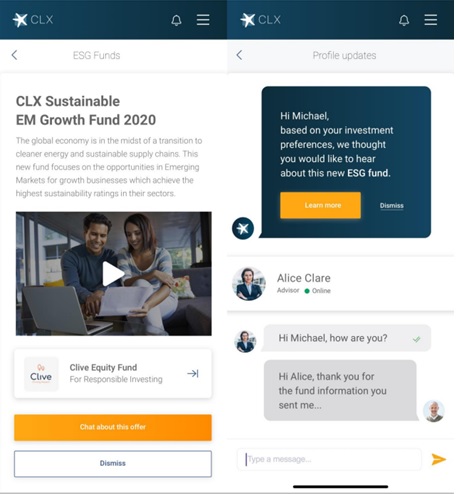

ESG is a complex area, but it is also a perfect example of how wealth management firms can leverage digital capabilities to improve client communication. Empowering clients to express their preferences can be a way to capture standardised data that can be reported on and start more personalised conversations. Even if a client prefers a meeting or a phone call, using the same framework means that data is standardised across the organisation, creating new efficiencies and a clear audit trail to meet compliance requirements.

For example, a client may express a wish to invest in companies with female and diverse leadership. These are criteria that can be measured, but the conversation doesn’t end there – as well as tailoring marketing communications to be focused in this area, it is the ideal opportunity for wealth managers to demonstrate their value by initiating a further conversation about the details of this preference.

In this example, it’s worth noting that according to the Peterson Institute for International Economics, a survey of 21,980 firms from 91 countries found that profitability increased by 15% on average by having a woman in the C-suite. In addition, female-led companies generally have higher retention, stronger reputations and produce more patents. This suggests that a preference to invest in more diverse companies isn’t simply altruistic.

Studies show that companies with high ESG standards can deliver a strong long-term performance, so if that’s a priority for the client, it’s worth looking at what lies behind their values. Of course, they may opt to support those issues closed to their hearts, but clients may also be interested in other governance and ethical criteria that report similar benefits.

Just another tick in the box?

Addressing the MiFID II rules isn’t just about compliance – it’s about embracing the opportunity that ESG investing presents. The intergenerational transfer of wealth is a significant factor – as women and younger investors are in receipt of their inheritances, they are more likely to ask questions about ethical considerations.

A report from Morgan Stanley produced this year suggests that 95% of millennials in the market want to tailor their investments to their values. As more of this generation joins the market, the number of investors is set to grow significantly. A study from EY highlighted that advisors generally lose between 70% and 80% of assets at the point of inheritance.

Digital ESG investment solutions which empower clients to take control of their investments and show clear reporting against ethical issues can also be a way to engage with younger investors in receipt of a bequest and ensure greater retention across generations.

How do these rules fit with current suitability criteria?

The new rules on ESG investments are not a replacement for current suitability criteria, nor do they take precedence. It is another layer of transparency for clients and one which is ideally suited to be delivered digitally. This doesn’t cut the wealth manager out of the equation – on the contrary, it is a perfect way to demonstrate value because of the need to join the dots between suitability and sustainability when it comes to investment.

Over time, ESG investment criteria will become an integral part of standard fact finds and annual reviews, but how they’re delivered will make a big difference. A digital solution can be used to capture the raw data and deliver automated reports based on that data, but it will be the execution of those preferences and the added detail of the personal service that will make a real difference to clients.

What do we do now?

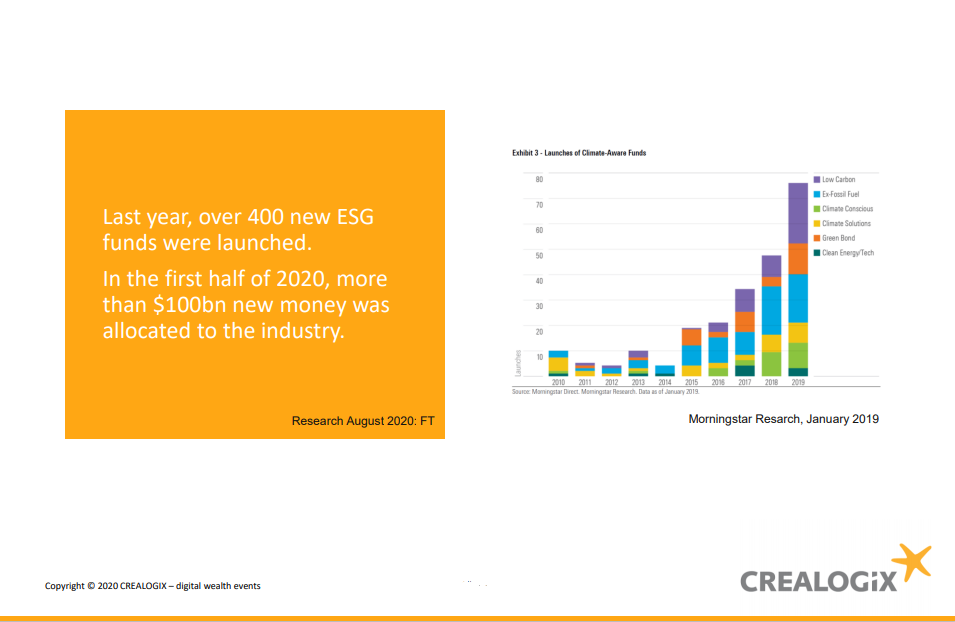

The ESG investment revolution has already started and the latest MiFID II requirements simply cement its presence in the mainstream. A report from ETF Flows highlights that in the first six months of 2020, new flows into ESG funds reached $15bn. This pace of growth looks set to surpass 2019’s record quadrupling of funds compared to 2018.

Using technology to communicate ESG investment opportunities does more than simply address the compliance challenge of the latest rules. Standardised data brings new administrative efficiencies, and a fresh approach to compliance that means the firm will be well placed to deliver against new requirements when they inevitably arise. This isn’t just about complying with the latest rules. A digital ESG solution that empowers clients can be a significant differentiator, particularly when it comes to gaining new, younger clients and retaining inherited wealth.

CREALOGIX supports wealth managers seeking to implement a system of engagement for a truly digital wealth service. Taking both consumer demand and regulatory requirements into account, we help to bridge the capability gap regarding user experience and offer a range of tools to help wealth management and investment management firms put digital at the heart of their service proposition.

Speak to CREALOGIX today to find out more about our digital wealth management engagement software and how it can help you improve your digital user experience and address the latest compliance challenges.