What has already been implemented in retail banking is now also evident in the business banking segment: customers expect intuitive processes and single gateways that cover all the needs their business demands. This is where digital ecosystems in business banking come into play.

A recent study by CREALOGIX demonstrates that customers’ expectations for business banking solutions are immense, despite their own companies sometimes limited degree of digitization. Beyond customer expectations, factors such as slow market growth and increasing competitiveness, particularly in the upscale SME market, hinder the long-term success of business banking.

To remain competitive in business banking, it is crucial to provide small and medium-sized enterprises with added value. Banking applications must be intuitively designed, ensuring a seamless integration of third-party apps. Multibanking represents a significant step toward the future; however, it is not sufficient to secure market share in the long term. Those aiming to excel in business banking cannot disregard digital ecosystems.

What is a digital ecosystem?

Digital ecosystems consist of a complex network of organizations, services, and technologies that are interconnected and specifically tailored to the user's needs. The purpose of a digital ecosystem is to fulfill diverse customer needs through a seamless user experience, all through a single point of access. The services and products offered go beyond traditional financial products and address needs stemming from various aspects of life, such as geographic or demographic conditions. Particularly conceivable are offerings from areas such as real estate, facility management, energy, or mobility.

Digital ecosystems play a significant role in the future of business banking

In retail banking, we can already observe the changes brought about by digitization: traditional banks are partnering with fintechs, expanding their portfolios to include both bank-related and unrelated products and services. Core business processes are changing, as is the way customers communicate with their banks.

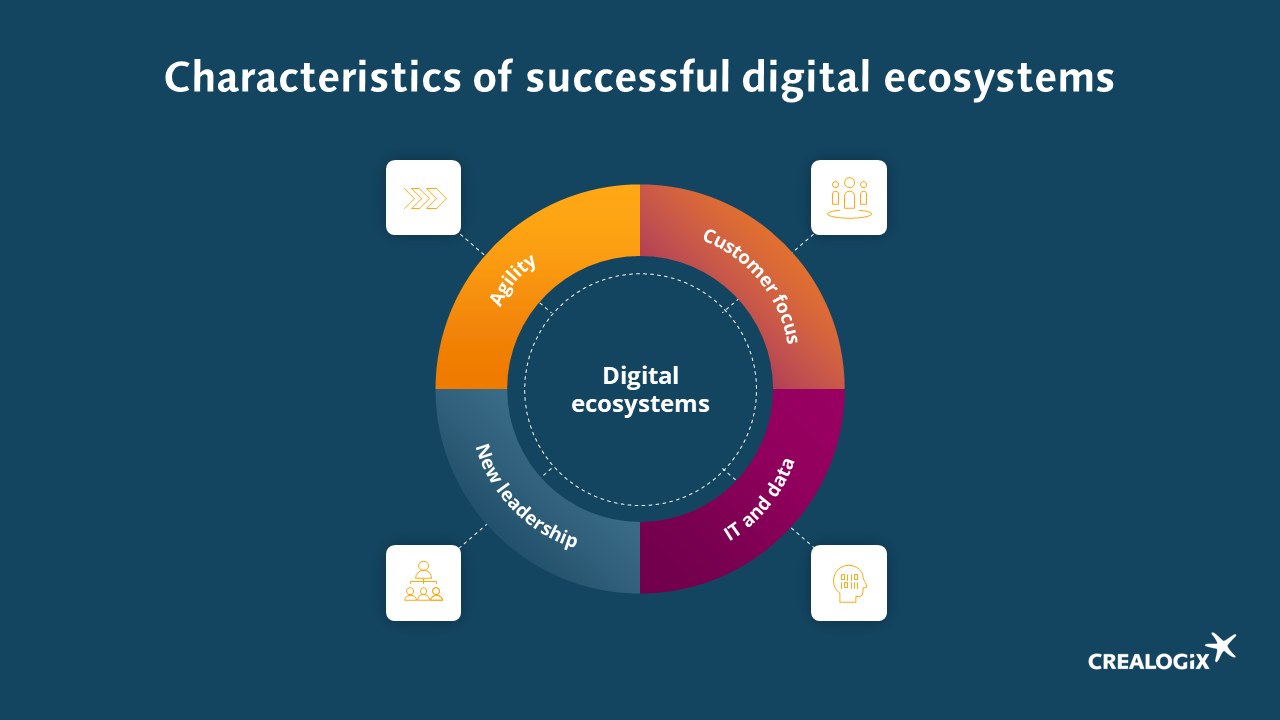

This trend isn't bypassing business banking. Financial institutions must form partnerships and integrate third-party services to remain relevant in the daily operations of businesses and be perceived as the primary finance brand in the future. However, above all, one thing must happen: the mindset must fundamentally change because a successful digital ecosystem cannot be built with proprietary knowledge, rigid processes, and the traditional concept of leadership.

The advantages of digital ecosystems in business banking are clear

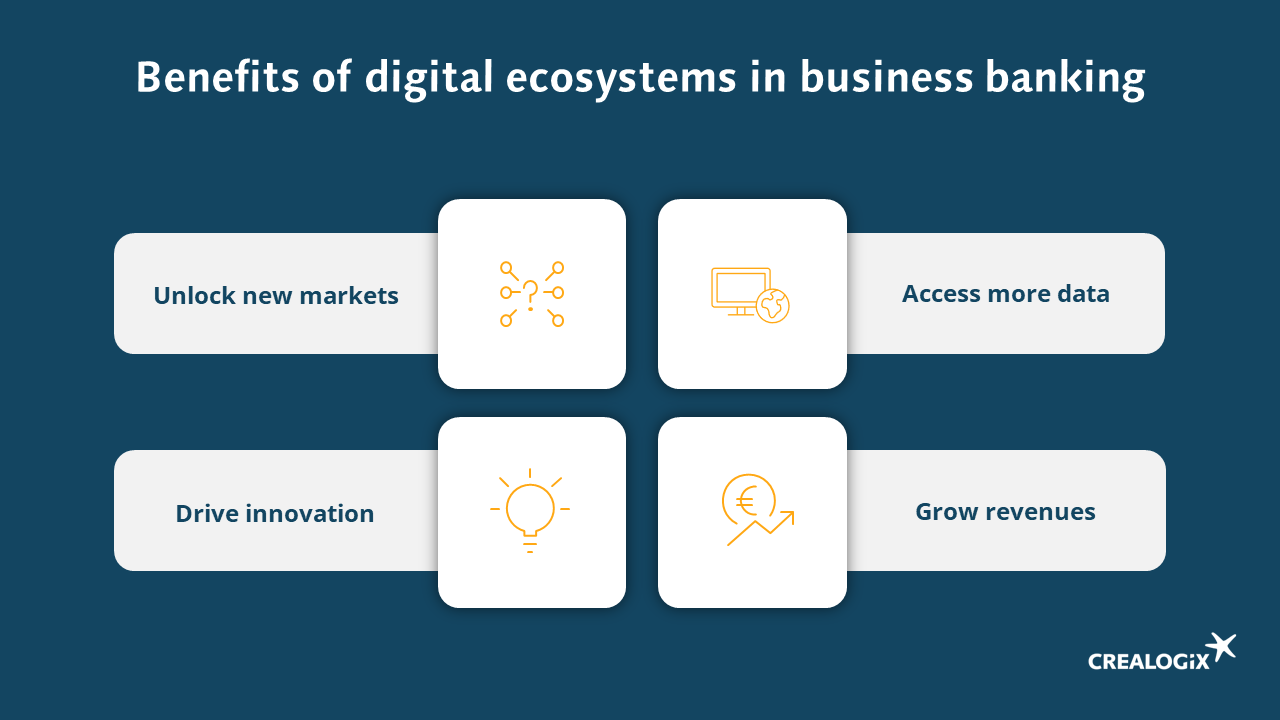

Orchestrators of a digital ecosystem in business banking reap numerous advantages, ranging from valuable branding effects to enhanced innovation capabilities and the exploration of new markets. Among the key benefits are:

- The integration of external products, both closely related and unrelated to banking, offers cross-selling potential and ultimately the opportunity for higher revenues. Embracing the platform economy addresses more needs, leading to increased customer satisfaction and willingness to pay for the overall service. Despite bringing in external players as additional service providers, banks, who serve as the orchestrators of such ecosystems, ultimately yield higher returns for each provider.

- Collaborating with other service providers also grants access to more extensive datasets and, consequently, a myriad of additional benefits: improved accuracy in personalizing offers, early identification of general trends, or a more comprehensive, data-driven risk assessment.

- The mentioned study reveals that surveyed participants, financial institutions for businesses, view neobanks as innovators but not as serious competitors in business banking – so far. This is partly because neobanks cannot match traditional banks in terms of compliance and the human aspect. However, as established banks, it makes sense to enter into strategic partnerships with fintechs and neobanks to adopt specific functionalities or offerings, thereby enhancing innovation capabilities.

- A digital ecosystem also presents the opportunity to explore new markets, whether in terms of customer segments or territories and to expand the service and product portfolio. Through an ecosystem, the limitations inherent in being a single player can be fundamentally overcome.

Tomorrow's business banking requires a shift in mindset

In retail banking, it's long been recognized that this isn't just a passing trend. Now, it's up to business bankers to follow suit: by embracing a digital ecosystem, business banking institutions position themselves as long-term partners for their customers. They no longer merely serve as funders, financial advisors, or the like – they offer clients solutions tailored to a variety of their work and task areas, addressing the needs of their professional lives.