After a thought-provoking session from fintech strategist Chris Gledhill as part of the CREALOGIX Open Innovation Day 2020, we had several questions from delegates wanting to know more. We sat down with Chris to get some answers to their questions.

When you work with incumbents do you see them taking the challengers seriously?

I do think that the incumbents understand the size and nature of challengers. That is a quite significant change that has happened over the last two or three years but although the threat is acknowledged, I am not sure that it’s being fully addressed.

Large banks are still working on the assumption that they are cushioned from the impact of disruption due to the size of their customer base and the strength of their brand. Similarly, established wealth management firms that do not seek to operate at scale feel secure with their current client base and secure reputation. Change is always a risk and it’s often safer to do nothing. There is also the effect of what I call the “bankers’ equation” and can also apply to wealth management firms. Many of the people with the power to effect change are close to retirement, and if the time to disruption is greater than the time to retirement, many executives will decide to play it safe and stay with models that have worked for the last 200 years rather than risk a difficult end to a successful career.

This isn’t an issue that is confined to financial services; very similar behaviour can be seen in all industries facing disruption. There are notable examples of companies that didn’t act quickly enough when it came to disruption, such as Kodak’s handling of the arrival of digital photography or Blockbuster dismissing the potential threat of Netflix. The latter is a good example of what not to do – rather than work with or seek to acquire Netflix, Blockbuster choose to develop a completely separate platform and couldn’t pivot quickly enough to retain a foothold in the market. This doesn’t mean that change is impossible or that disrupters are destined to prevail in the market. BT is a great example of a company that completely transformed, from telephone landline provision to a communications provider offering broadband, media services and more. Similarly, few know that Nintendo is a historic company founded in 1889 and actually started out producing board and card games before moving into computer games. These examples are quite rare, but there is much to learn from them. The most important element is that change must come from the top and requires strong leadership. Challengers in the market are very much like the iceberg in the path of the Titanic – it doesn’t matter how many people on deck spot the obstacle, the message has to reach the Captain, and the Captain must then act on this information if the ship is to change course.

What’s giving the challengers an innovation advantage? What’s different when you speak with their leadership?

Challengers in banking and wealth management often have digital native leadership. In addition, they are often ambitious and entrepreneurial. They have a very clear ideas regarding what their mission is. It is their intent to disrupt the market, often to address an unmet need or provide a social benefit, such as providing services for the unbanked or financially excluded. This clarity of vision is something that everyone in the company can understand, believe in and work towards. If we compare this with an incumbent bank, there’s not only the “bankers’ equation” mentioned above but the fact that there’s no clear mission that has an emotive, inspiring and cohesive effect on the workforce. There is little sense of working for the greater good to right a social wrong, the focus is often on increasing shareholder value or, in short, making more money.

Challengers are also starting from a blank slate. There are no legacy systems, leaders can hire people directly into roles that bring not only the required skills but also aligned values. If we compare this to a large bank, staff are often moved around to different departments for career development or internal political reasons. When it comes to staff, it’s a little like refurbishing an old Victorian house. It’s cheaper to knock it down and start again, as we see with challengers building organisations from the ground up. That doesn’t mean there aren’t good reasons to keep the original features and qualities of that house – but it will cost more in the long term.

Challengers also have the reputation advantage. The target audience of these challengers has a negative view of the incumbents and their association with the financial crisis and the recent money laundering scandal. In contrast, challengers are untainted by those scandals. As well as feeling fresh, challengers often have a social mission and an integrated Corporate Social Responsibility (CSR) policy which integrates fully with their strategy to further differentiate themselves.

As well as these differences, there is also a completely different environment inside challengers and incumbents, particularly when it comes to implementing new ideas. Challengers have access to capital and the ability to raise large rounds of funding; in addition, once the funding is secured the organisation is given free reign to deliver new developments at pace. In contrast, many incumbents are focussed on “keeping the lights on” with legacy systems. Innovation is kept on a very short leash and within a very tight budget. This atmosphere doesn’t foster innovation and budgetary pressures lead to an element of micromanagement and delays due to tortuous approval processes. If we go back to the example of the Titanic, imagine if you had to compile a 20 page PowerPoint with a robust business case for changing course to avoid the iceberg to present to the Captain; you’d sink before you got the budget approval.

If established financial brands are aware of the challenge, what do you see holding them back from innovating?

There are three key areas that are stifling innovation in established financial brands. The first is mentioned above – the baggage of legacy technology. It is often expensive to maintain and refurbish, very complicated and with very few people on staff who understand how it all works.

Closely related to this area is another form of baggage, this time cultural. Office politics, a fear of taking risks that may fail and “little chiefdoms” with siloed areas of activity or focus all play their part in bringing about a culture where resistance to change becomes entrenched. If we look at big tech for a contrasting example, staff at Google are actively rewarded for sharing information regarding their role, from documentation to staff training. This is how staff at Google can progress to the next rung in the career ladder. In contrast in the incumbents, we see staff who don’t document often labyrinthine processes and practices because it makes them indispensable in the organisation and, when it comes to technology, required to sign off any changes. These are the employees that will actively fight against change and frustrate any attempts to bring about new solutions that may feel unsettling.

This is where the third factor comes into play; innovation needs to come from the top, from leaders who actively foster it. We heard from DBS on Open Innovation Day 2020 and that’s an organisation that is seen as more progressive because the leadership team understands what it takes to deliver meaningful change. Often the leadership at large incumbents don’t even understand what the challenge is – the board is comprised of financiers who have extensive expertise in their field but don’t understand technology. Expertise in digital banking is needed right at the top – not a Head of Digital role which operates as little more than a utility service to manage computers and phones within an organisation, but a role that is clearly stated as a CEO who is taking the lead at a digital bank.

What changes in culture and management strategy will help incumbents innovate faster?

As I’ve mentioned, the culture of an organisation has an immense impact. The fact is that all the big banks have acknowledged the threat of challengers, all have brought in consultants that recommend a radical programme of digital and cultural transformation. Many of these organisations have hired experts from big tech to spearhead this change, but it is often smothered by the size of the organisation. Former Directors of companies such as Apple and Google often leave big banks after short periods due to frustration. The change needs to be managed from the top down – unless the change comes right from the top, it is likely to become smothered or distilled to an extent that it has little effect.

Greater openness can make a big difference when it comes to accelerating change. Collaboration and open innovation are essential. It’s important to engage and work with others in the industry. Rather than trying to innovate in isolation, sharing information is vital, particularly in areas such as open banking and APIs. This sort of collaboration isn’t impossible – banks already collaborate on fraud monitoring, for example, but that’s a programme that helps banks. What is needed is the same level of co-operation when it comes to helping customers. The possibilities of this collaboration are endless and could lead to a more user-friendly service and greater engagement. Imagine, for example, a student arriving at the University of Manchester from elsewhere in the country. Information from their bank on budgeting requirements – accommodation costs, food and travel costs and more – could be invaluable and improve engagement with the banking brand as a helpful resource. Banks have these data; it is a question of making use of it and they can’t do that on their own.

The key to accelerating change is to reach out to other banks and implement effective collaborations with fintech’s. This sometimes happens for a proof-of-concept idea but not large-scale projects. What would make a big difference would be to get heads together to discuss the future direction of the industry and how they might work together. It’s important to note that big tech already know where the industry is going and they’re making strides forward. There are a lot of international banking conferences, but often what takes place is that each organisation broadcasts their current projects and there is little collaboration or discussion on what banking could or should be. If money makes the world go round, then changing the way we all manage money could change the world. Established banks are well placed to spearhead this movement; collaboration could bring about positive change not just for banks, but on a social level.

With so much at stake, banks need to be decisive. The digital train is leaving the station and big banks and established wealth management firms should be on it. It will require significant reform, not least addressing changing workforce requirements. Different skills and aptitudes are required than are often not found in incumbent organisations. Challengers are often building something new with a workforce of less than 200 people; big banks have tens of thousands of people, but they are not aligned to any clear goals or faced in the same direction. Finding a common cause can have a uniting effect – a clear vision that excites and inspires the whole team and a goal to work towards is a pivotal moment when it comes to delivering meaningful change.

It may seem like it’s impossible to unite such a large workforce under one simple goal, but it’s not. Simplicity is the key to success. Again, the example of DBS shows how it can be done. The organisation has a clearly stated vision – to be the best bank for a better world. The bank’s vision is “best bank for a better world” and their mission is “we make banking joyful.” All staff are united under this banner, each role is focused on realising the vision and achieving the mission in whatever capacity their function requires. In addition, it has the added benefit of attracting a workforce of people who have share these values and have greater commitment to the mission. Top down management of change and a clear vision make all the difference when it comes to accelerating innovation.

What are the specific technologies that you believe banks and wealth management firms should be racing to implement right now?

One of the most urgent changes required is for banks and wealth management firms to collaborate closely with fintech’s to reduce friction when it comes to onboarding, including the fulfilment of KYC and AML regulations. Customers expect seamless services and when compared to challenger onboarding, which takes as few as three clicks and a simple uploading of a photo of a driving license, a drawn-out paper-based process that requires forms to be sent, checked, copied, signed and resent seems at odds with wealth management firms promising a premium service. The tools are already available to deliver this sort of seamless, digital onboarding and while some clients may prefer the reassurance of paper, more and more people are inclined to move on if onboarding takes too long or creates onerous administration.

Open banking is here to stay and banks need to do more than pay lip service to the concept. APIs and connections with other organisations on set contracts can support collaborative innovation. Collaboration works both ways, so as well as sharing your own APIs, consider ways to consume available data and connections with other organisations inside and outside of Financial Services. It’s important to look beyond the minimum requirements of the mandate and consider how to monetise this facility and provide value to customers. Consumers are moving towards a more holistic view of wealth and ideas that let them earn interest on their interests, from reductions in health and fitness costs or education to ethical investments, can add significant value. Clear dashboards showing everything in one place can boost engagement and loyalty.

Automation is another key area of development. AI can be invaluable in reducing manual processes on the back end with Robotic Process Automation (RBA), increasing efficiency and reducing costs. When it comes to frontend digital services, chatbots and robotic advisors can accelerate simple, process led enquiries. As well as offering a simple and convenient service, this frees up staff to deal with any more complex enquiries personally.

Unsurprisingly given the above trends, there is also a huge focus on data, especially in wealth management. Of course, people are important, but wealth managers need all the data in front of them when meeting with clients. Big data analytics can provide valuable insights and enable wealth managers to present information to a client so that they can make an informed decision. Helping clients understand their finances better and engage with their investments using data doesn’t make the whole process more clinical and devoid of the human touch, it helps to build a more personalised relationship.

Any final thoughts?

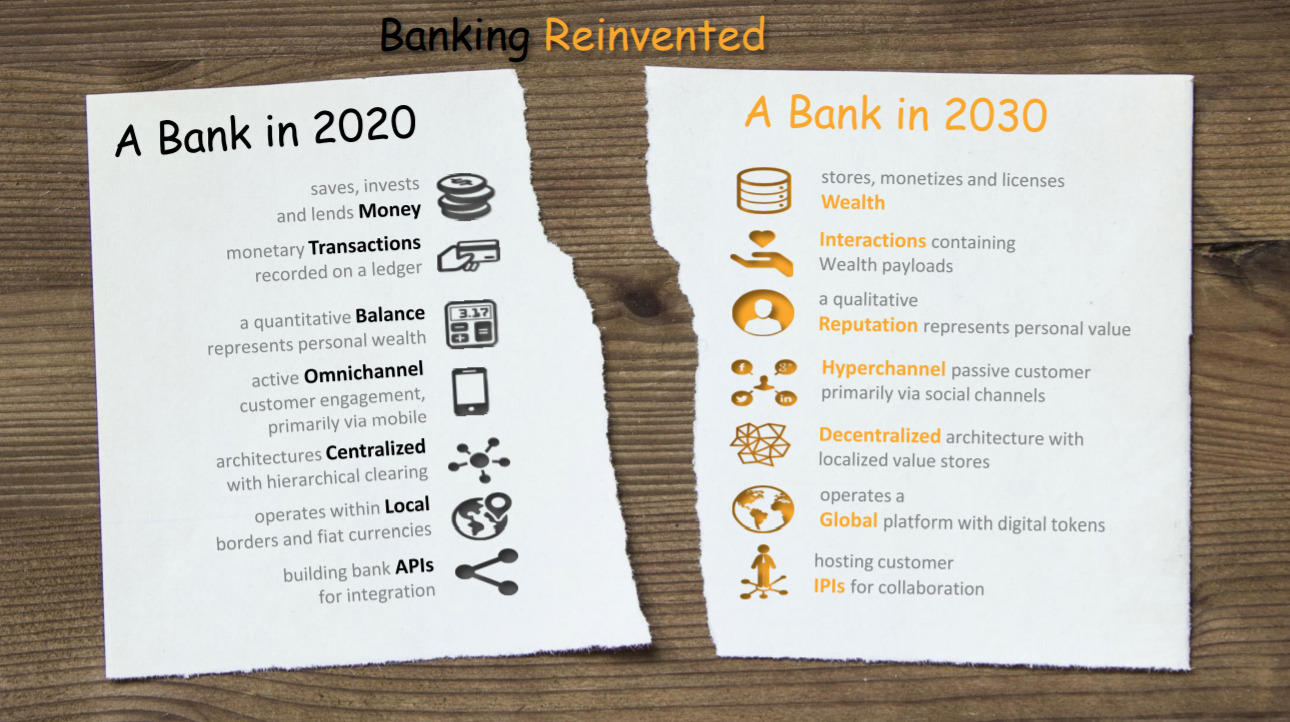

The FinTech movement up to now is just the warm-up act. We’re at the cusp of a significant change in banking and wealth management – not just a digitisation of the industry but redefining the whole concepts of money and the diversification of what it means to be wealthy. This is not just an incumbent industry looking to reinvent itself – it’s a huge opportunity for large tech and retail companies outside of banking. With the right mind-set, leadership and vision these challenges can become opportunities, what might seem scary will be exciting and an industry often accused of being self-serving can contribute to a better society.