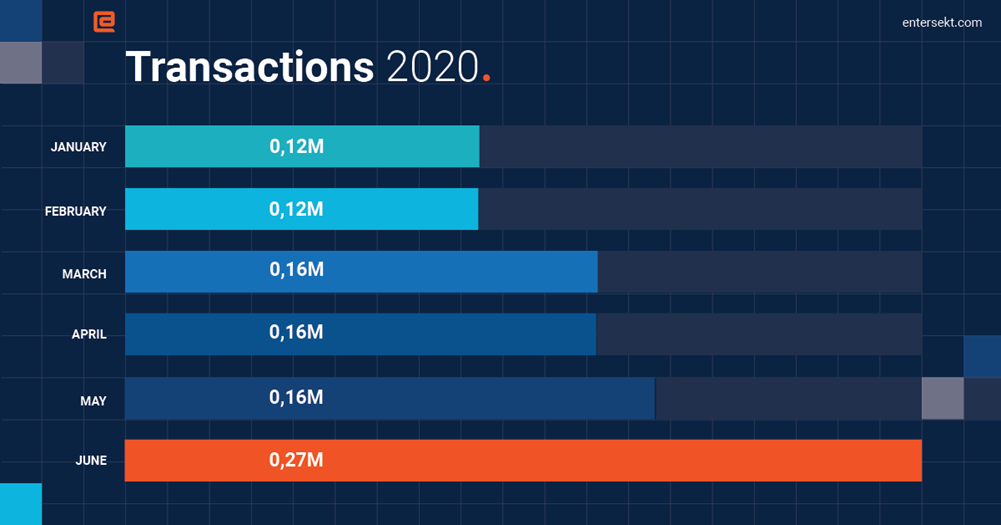

Digital and mobile banking services offer customers great convenience, but convenience must not come at the expense of security. Almost 18 months ago, as part of a joint project with Entersekt, CREALOGIX launched a solution that enabled banking customers to authenticate themselves quickly and easily and thereby make payments and other transactions securely. In June 2020, champagne corks popped to celebrate the milestone that users had confirmed their identity with our PushTAN authentication over a million times! The figures show a high demand for the solution with a solid increase in usage over the past months, and the trend continues to point upwards.

Everything in one app

Thanks to Entersekt’s patented technological core, the security query is made directly in the mobile banking app. To log in and complete a transaction, users simply confirm a pop-up message within the app. Uwe Härtel, Country Manager Central Europe at Entersekt explains: “Given that everything happens in one application, we minimize the risk of data misuse. Other methods, such as those using SMS and separate TAN apps, do not offer this protection. The fact that our solution is being offered worldwide shows that awareness around security in digital banking is growing.”

In addition to security and convenience, this form of authentication comes at a much lower cost. Users save on SMS charges, which increases satisfaction with their provider. Financial service providers can meanwhile implement the procedure with minimal effort and purchase it as a SaaS solution at a very low cost. It can be used for all our digital banking products.

“Our cloud solutions that are tailored to the Swiss financial sector can be used in many ways and are based on established security and compliance standards,” says Uwe Härtel.

More than a security feature

Rising transaction figures confirm that PushTAN authentication has allowed us to overcome one of the biggest hurdles in digital banking: By improving the customer experience, customers are using their banking application more often – to make transfers, manage standing orders and check their account balance. As more services are used, a bank generates higher profits and drives customer loyalty. Choosing the right authentication method can therefore represent an important competitive factor in retail banking.