CREALOGIX recently collaborated with Compeer on some research analysing the attitudes of the C-Suite to digital solutions in wealth management. When it comes to technology, the three key priorities for wealth management firms when assessing various options are the reliability of the solution, the cost and the projected ROI. While these are reasonable measures, it shows that neither the client nor future strategic goals play a key role in the decision-making process.

There are various goals which can be allocated to digital solutions, and each of these objectives will also include consideration of the priorities listed above. Three possible objectives for digital transformation are:

1. Retaining and developing existing customers

Digital self-service and communication channels don’t put distance between clients and the firm – the right solution can increase engagement with existing clients by augmenting in-person services in a way that may uncover opportunities for further investment opportunities.

2. Attracting new customers

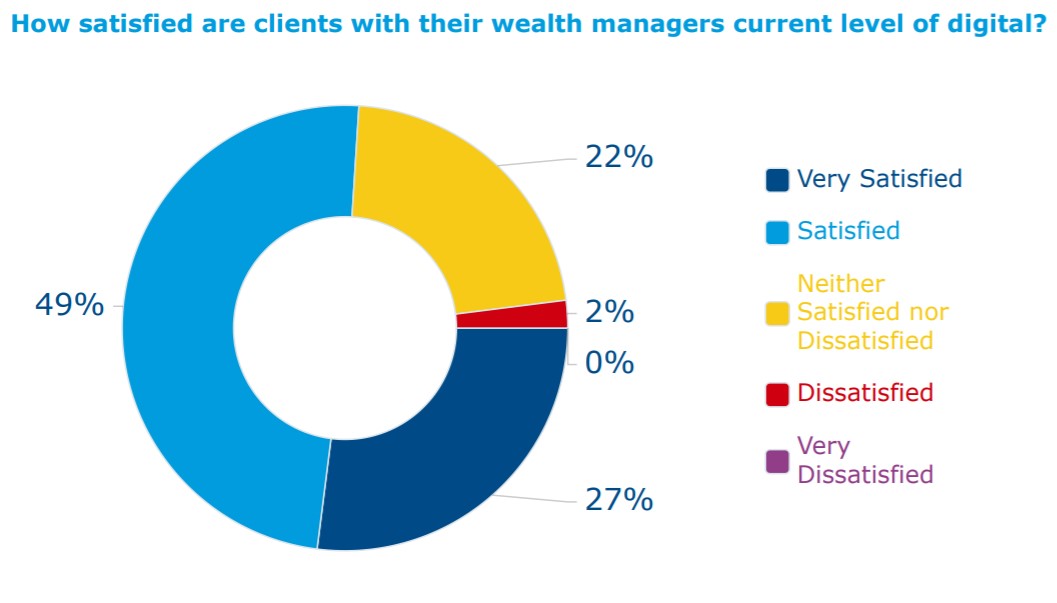

A secure, easy to use digital solution can be a way to differentiate your brand and attract new customers. In some cases, this may be younger heirs of existing clients who are aware of your firm and looking for a digital dimension to the services they receive. The Compeer research shows that a quarter of investors are currently dissatisfied with the digital service they receive, which suggests there is a significant opportunity in attracting investors currently frustrated with the lack of digital solutions from their existing provider.

3. Providing existing services at scale

Digital solutions can be used to provide personalised services at scale, realising the potential of the first two objectives. From digital self-service options to personalisation, any digital solution can be used as the platform for increasing the volume of clients without sacrificing the personal service which serves as the foundation of the firm.

Clear commercial goals can be allocated to digital transformation, and while reliability, cost and ROI are certainly important factors, the most successful firms will align digital goals with strategic goals. Closely linked to ROI is the potential for efficiency gains across the organisation. Digital transformation may provide a reduction in costs elsewhere in the business. For example, self-service administration options may reduce administration costs, and secure messaging with a full audit trail could further reduce the firm’s costs in ensuring regulatory compliance.

With Compeer research showing that smart phone saturation in the UK is at 78% and the pandemic accelerating the use of digital services, it’s clear that a future-ready firm must integrate digital transformation into their business strategy. At heart, the principle of prioritising the client is the same, it’s simply a new channel to extend the current service and can be used to augment both in-person services and a wealth management firm’s brand.

Find out more and download the full research report here.