After an extraordinary year in the financial industry, one important realisation is a greater need for the rapid launch of contemporary digital offerings. Financial institutions are upgrading in the areas of mobile and digital banking, creating ecosystems and launching digital second brands. One basic condition is the availability of data, with a requirement for uniform access to data and secure use through integration layers. These act independently of release cycles and change requests in the back-end architecture and thereby ensure flexibility and speed.

The trend from simple e-banking to mature ecosystems that connect different areas of customers' lives has already been established at Swiss banks in various forms. The wider aim is to gain relevance in the market with rapid rollouts and offer solutions completely digitally, from initial contact to closing, communicating with customers in a simple, understandable and trustworthy way.

Mobile and digital banking are thus becoming more and more integrated into everyday customer life. But as usage increases, so do the requirements, so it is important that findings on usage quickly flow back into development in order to test and introduce new functionality. For example, is a recommendation function missing? Should a rapid cross-selling offer be tested by analysing previous user actions? And how is performance affected under heavy demand?

Available data and independent front-end

Answers to these questions are only known to those who have the data on digital services available in a robust form which is transparent and promptly evaluated. This allows new UX/UI and digital banking features to be implemented rapidly.

In addition to the availability of data, it is also important to reduce the dependency of the front-end of a core banking system to a minimum. After all, to meet the high expectations of today's digital customer, front-end response times and adaptation cycles must be higher.

Decoupling for rapid time to market

Detached from the sometimes outdated back-end architecture, new services can be developed independently and launched simultaneously. This makes them accessible anytime, anywhere - and by 'anytime', we mean real-time availability. This enables fast development and release cycles, which are crucial for successful digital banking providers. You can implement omni-channel strategies, make products more dynamic and automate processes. So how can this be implemented technically?

Unified Data Language

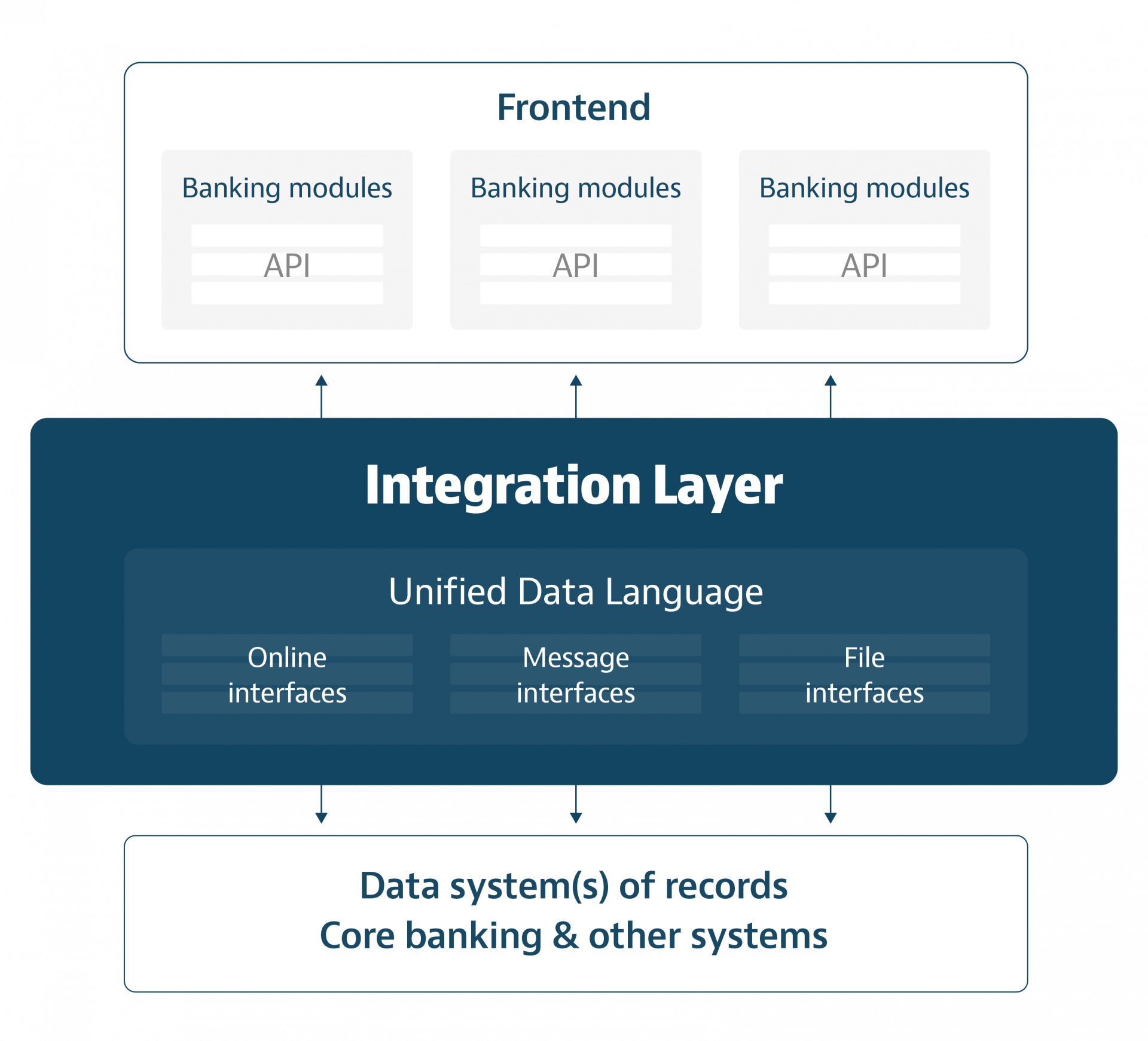

The first step is to unify data. Integration layers enable this step and allow front-ends to communicate in the same "Unified Data Language". Regardless of whether the data originates from core banking systems, CRM or other analysis tools, the data is unified in the integration layer and thus made usable. To guarantee security at all times, it is possible to identify and protect sensitive data.

Reliable interfaces: secure, standardised and certified by core banking providers

With this unified data, the UI can now be optimally configured and data can be cached to match the performance of core banking systems. Data conversion is thus an integral part of the interaction layer and enables fast time-to-market. New functions can be added at any time by additional data migrations. It is advantageous if the integration layer is also certified by the core banking manufacturer, thus preventing any compatibility issues.

The interfaces are the be-all and end-all of an integration layer and can be divided into three important components:

- Online interfaces are used for real-time requests. This is essential, especially in the area of contract management. Online interfaces include all REST APIs, as well as token-based access for APIs.

- Message interfaces are bi-directional, asynchronous interfaces that are particularly suitable for high loads and, for example, brokerage transactions. Experience has shown that alerts, business calculations or other information required by the front-end should be exchanged via these interfaces.

- File interfaces exchange all kinds of data types, such as master data retrievals, asset data and currency data.

Rapid go-to-market and more services for customers

Free connections can now be made at the open data layer, in addition to the actual front-end. The result is an open system that can be integrated quickly. Access is possible for the financial institution itself, or for its partners. What does the new data usage mean? Data-driven banking services can be deployed in the following ways:

- Integration with partner ecosystems

- New forms of user interaction, e.g., conversational banking

- Microservices

- Modern services in the areas of transactions, advisor, self-service, payments and accounts

- Integration of CRM data

If the front-end is decoupled from the core banking system, better customer interactions are achievable. Integration layers free data from core banking constraints: data-driven banking, personalised offers, data-driven services for the customer and automated processes, with fewer manually-driven but non-value-added actions, modernise the digital banking offering.

In the case of monolithic IT back-end architectures, the integration layer offers huge opportunities to achieve the flexibility and speed needed in the competitive digital banking market. In this way, a bank can secure important competitive advantage in an increasingly digital world.

IFZ Sourcing Studie 2021