Open banking – access to customer and transaction data for third parties – has fundamentally changed the landscape for financial institutions. While many see this as a potential threat, the opportunities often outweigh the risks, at least for institutions that recognise its potential as part of a "beyond banking" strategy, opening up new sources of income beyond traditional banking.

Open Banking Platforms study

So, what is the status of open banking? What opportunities are there? Where are the risks? And how can they be avoided? A recent study Open Banking Platforms by German management consultancy PPI AG, which CREALOGIX participated in, addresses these questions.

The study reveals that open banking enables institutions to offer a wide range of innovative products for private and corporate customers, in cooperation with third-party providers. This ecosystem is based on APIs (Application Programming Interfaces), as well as regulatory requirements from the Payment Services Directive 2 (PSD2). Connected to an open banking platform, modules allow the introduction of new types of services within the banking ecosystem.

Integrating banking modules

Third-party providers are essential for the rapid development of a bank's range of products and services, according to PPI. It says that 48 per cent of the banking modules already integrated into the platforms examined come from third-party providers. Of the modules not yet integrated, third-party providers could already connect 57 percent.

In the area of retail and private banking customers, 59 percent of the banking modules requested have already been integrated into open banking platforms, while a further 22 percent can be connected within a year.

If banks provide further information or functions via their APIs, according to the study, they can also decide which third-party provider may access this information. Sparkassen-Finanzgruppe, for example, opted for this approach, using a specially developed open banking platform to provide access to more than 5,000 banking functions.

Open banking creates possibilities to establish data-driven commission income as a separate business model. Ultimately, says the study, data is the oil of the 21st century – and banks have an enormous amount of this new raw material.

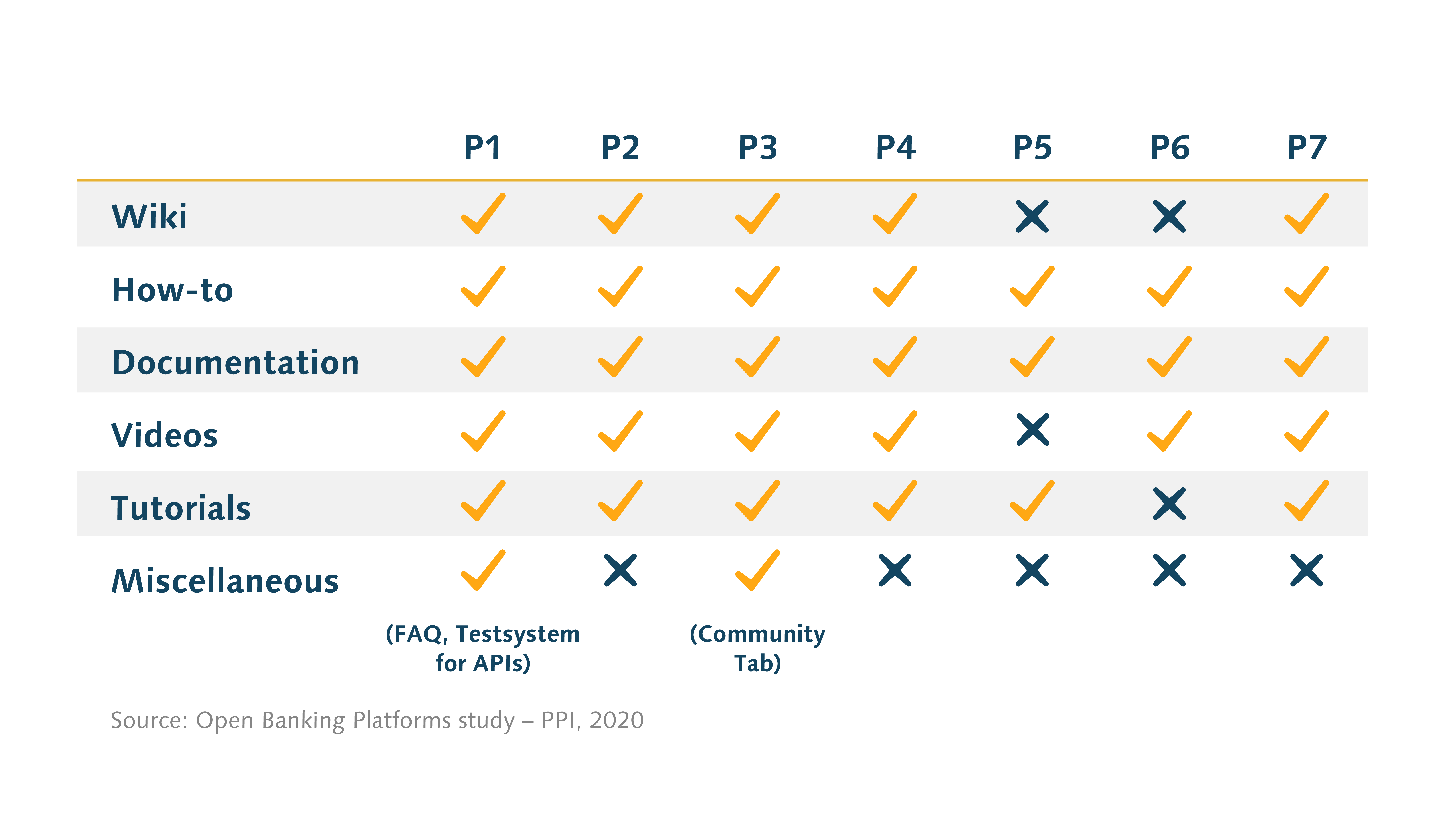

For the third-party providers to enter a bank's ecosystem, it is important that their respective modules can be connected to the open banking platform by means of appropriate APIs. To support this process step, all of the service providers surveyed operate a developer portal where they provide specialist knowledge, expert advice and special functions. In the graph here, P1 – P7 represent different providers and their support kits for developers on their portals.

Strategic benefits

Banks can benefit from open banking platforms in three key strategic areas, according to the study:

- Monetisation of APIs or platform use by third-party providers

- Increasing customer loyalty through stronger everyday relationships

- Rapid further development of products and services through cooperation with third-party suppliers

For third-party providers to enter a bank's ecosystem, it is essential that their respective modules be connected to the open banking platform via appropriate APIs. To support this process step, the service providers surveyed in the PPI study, including CREALOGIX, operate a developer portal where additional functionality, specialist knowledge and expert advice are included.

Aligning with customers’ needs

With an open banking platform, financial institutions can position themselves within the respective ecosystem as central intermediaries for various offers and services – and take advantage of promising sales markets beyond their own industry boundaries.

Future technologies such as smart cities, smart homes and digital healthcare are just a few examples of potential parts of such ecosystems.

With products and business models more broadly based in the future, financial institutions can align more closely with their customers’ needs. But this can only be achieved if they use open banking strategically and position themselves within new ecosystems.

The report concludes that, in the future, institutions must be able to offer products and services in every possible way through every possible channel, and that open banking creates an important basis for this.

Download a copy of the PPI study in German here: PPI Aktiengesellschaft: Studie Open-Banking-Plattformen