Going digital is not a minor or one-off project for an investment or wealth management firm. A successful strategy is one which involves all the stakeholders – across the front office and clients services as well as in technical / IT roles – in a long-term value-building effort. This means digitalisation must be high up on the C-level agenda and gain buy-in with leadership via a convincing business case.

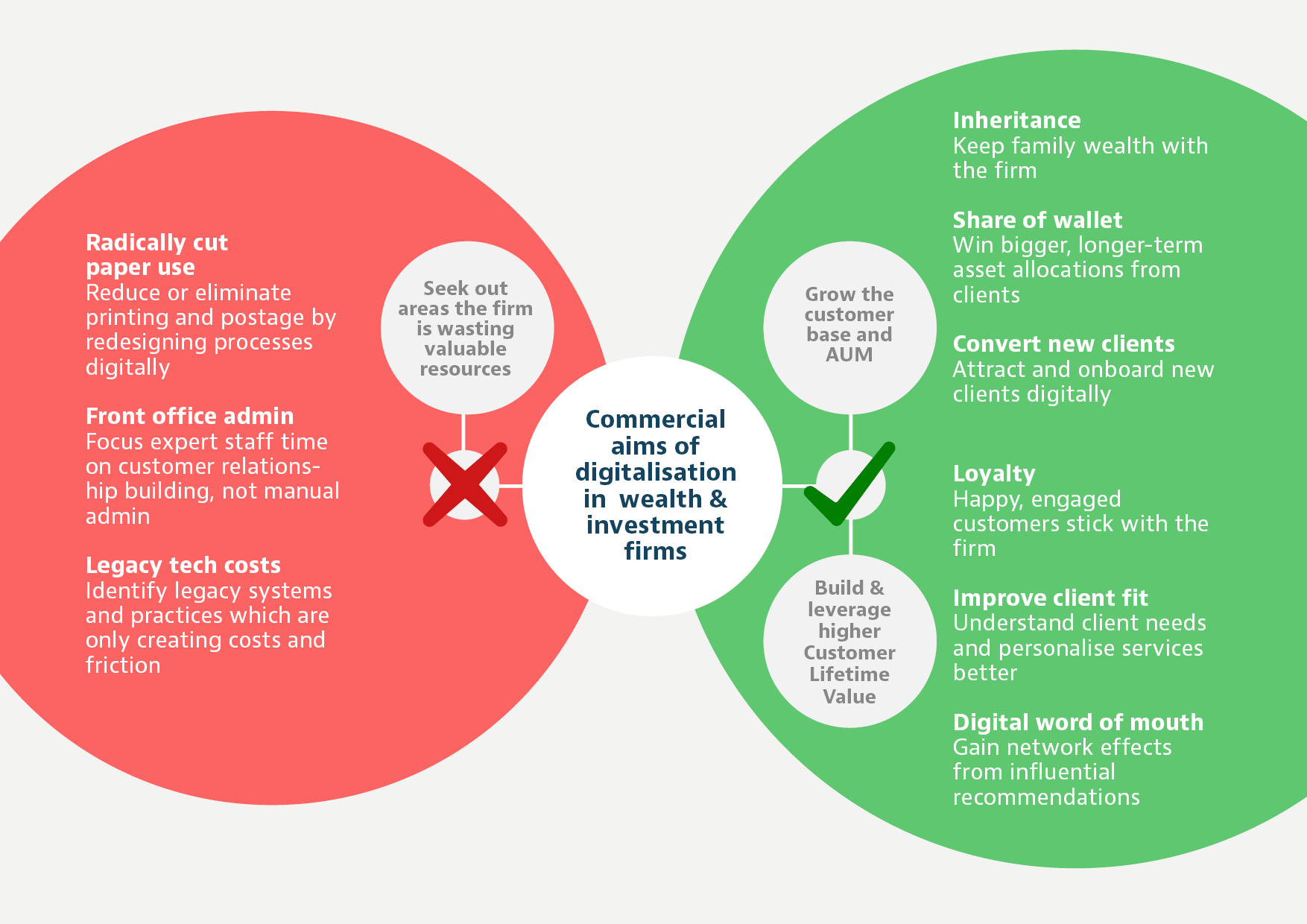

Advocates of greater and more rapid digitalisation within wealth can point to the following commercial drivers to set goals, demonstrate success, and help prioritise successive new initiatives:

These are all commercial performance levers which the firm is pulling on by investing more – and more smartly – in digitalisation. Some benefits – particularly by definition, client loyalty and lifetime value – are hard to measure in the short term. Therefore, digital initiatives should be justified with more directly measurable benefits in order to build confidence and consensus required for a successful long-term digital strategy.

Examples of quick win KPIs in digital

Digitally addressable customer base

What proportion of your clients are (a) active users of your digital services and (b) are able to receive relevant, segmented messages via email, app inbox, or notifications?

Digital satisfaction scores

With digitally addressable customers, you can ask smaller, more frequent, more targeted survey questions. What are customers saying in terms of an NPS score, app rating, or most requested investment needs?

Paperless clients and cost saving

What proportion of your clients have opted out of paper statements and other communications? What’s the cost of different types of letter? What’s the calculated saving?

Other readily measurable success metrics in digital services include:

-

Volume and handling of customer support enquiries;

-

Consumption of investor information (e.g. CIO news commentary)

-

Successfully completed self-service profile updates

-

Recency of suitability and fact find data

-

Conversion rate / duration of newly onboarded clients

Firms which move faster to achieve measurable and commercially impactful wins at an early stage will find it easier to align leadership and all stakeholders around the broader, longer-term, more transformative benefits of digitalisation. In summary, get new digital client access systems live first, gain proof and support, build the digital roadmap, and repeat the cycle!

Speak to CREALOGIX today to find out more about our digital wealth management engagement software and how it can help you improve your digital user experience.