In this report, the expert CREALOGIX team examines the key drivers of change and their impact on consumer behavior. The study also offers practical guidance on achieving commercial success with banking technology that prioritizes these new customer needs and preferences.

What are the key drivers of change in the banking industry?

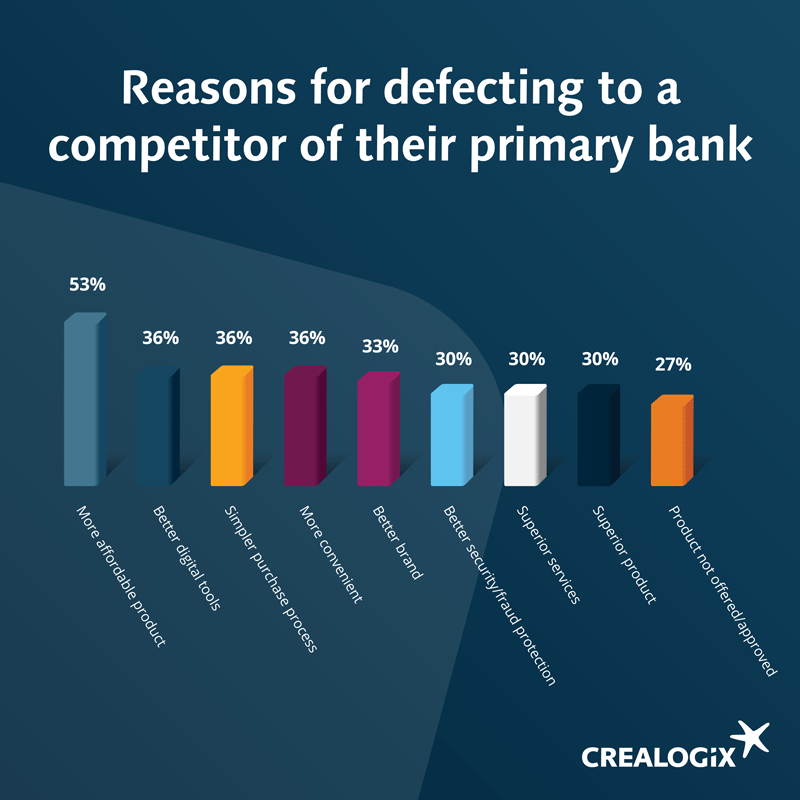

Digital transformation is an ongoing process, evolving as new banking technology and shifting customer behaviors shape the future of consumer banking. Recent years have seen significant changes, and their effects will continue to ripple through the financial industry. The arrival of fast-moving digital challengers and increased expectations have added to the pressure on banks. A study by Bain has shown that finance products with a digital self-service tools with high UX and affordable prices have become crucial:

The CREALOGIX report highlights the drivers behind the following key areas:

- Geopolitics

- Economy

- Society

- Technology

- Industry

- Demography

How to address these trends with CREALOGIX banking technology

Our banking technology solutions are designed to help banks such as Deutsche Kreditbank AG address the market’s requirements and capitalize on these trends. The report provides sample cases for customer-centric retail banking and insights into our banking technology, including:

- Hyper-personalization

- Digital marketing

- ESG and sustainability

- Consumer credit

- Data acquisition

- Digital currencies

Download the full report to understand how customers’ expectations and behavior have changed, and how financial institutions can successfully navigate through this with the future proofed CREALOGIX banking technology.