How do younger generations in Switzerland, Germany and Austria conduct their banking? How important is digital, mobile and Open Banking in their lives and how vital is easy access to a local Banking Branch? In a comparative study, the market research institute CENSUSWIDE commissioned by the digital banking software provider CREALOGIX interviewed approximately 1,000 bank customers each in Switzerland, Germany and Austria. The results shine a light on how 18 to 45-year-olds feel about banking and what their expectations of Banks really are.

The branch remains important

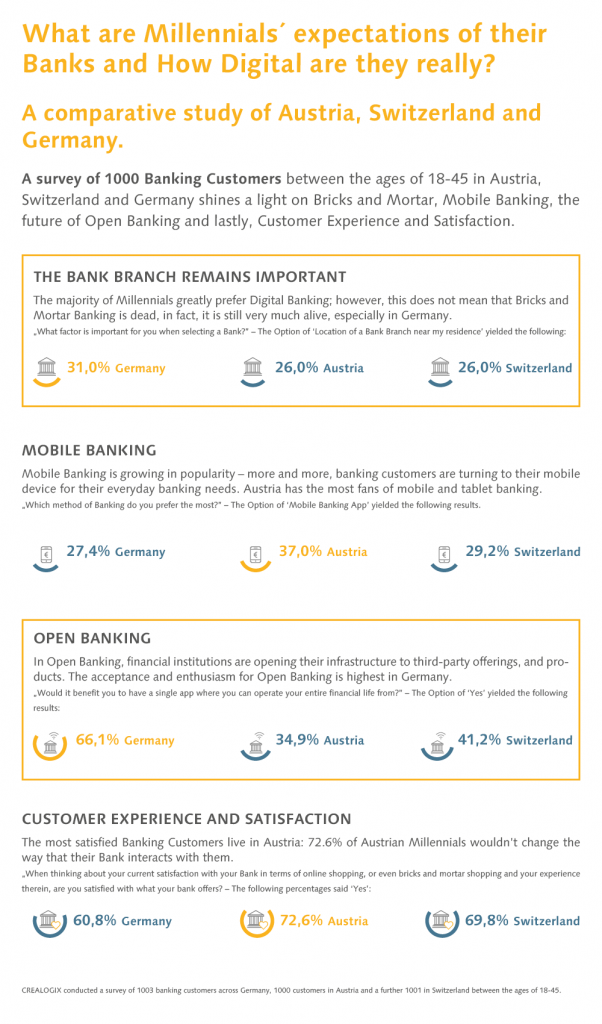

Millennials tend to be accustomed to achieving a great deal of their life-tasks online - so it's hardly surprising that digital channels are clearly ahead of the pack for the majority of younger banking customers. In Switzerland, 80% of them prefer digital banking to manage their financial affairs. In Germany, 79.8% of respondents stated that everyday tasks such as bank transfers and checking their account balance were also or exclusively done online. In Austria, this figure is even close to 90%. Unsurprisingly, the bank branch on site and a personal consultation is not nearly as important to many younger bank customers. However; the research did find that in Germany, this is different: 31% of Banking Customers said that it was vital to have a banking branch near their residence, and even stated that this would be a important criteria when selecting a Bank. In Austria and Switzerland, this figure is 26% each.

Maryam Danesh-Kajouri, Head of Global Product Marketing at CREALOGIX, says:

"Younger customers are using both the branch and online banking to manage their financial affairs – so a hybrid advisory approach is essential to meeting the millennials’ needs and desires."

Mobile vs. Desktop Banking

The enthusiasm for Mobile Banking is on the rise. Increasingly, banking customers are turning to mobile apps to access their financial lives and carry out everyday banking. In Austria, the survey found that 37% of those interviewed prefer banking via a smartphone or tablet. Switzerland and Germany are slightly behind with 29.2% and 27.4% respectively. The fact that the acceptance of mobile banking is already so high today is surprising, since mobile and peer-to-peer payment are often not possible despite the efforts of banks, fintech and technology providers. There is often no way around cash.

Great disparities in customer satisfaction

In terms of satisfaction with their bank, the research shows the discrepancies between the three countries. Bank customers in Austria and Switzerland are most satisfied: 72.6% and 69.8% respectively of millennials answered "Yes" to the question "If you think of your other consumption habits such as online shopping or visiting shops: Are you satisfied with the customer experience that your bank offers you?” However, many financial institutions in Germany are evidently in the limelight in terms of customer perception: 39.2% of Millennials still see room for improvement in their bank's service. Among 18-24-year-olds, only 57.4% of respondents are fully satisfied with their bank. Especially in Germany, credit institutions are challenged to question the modernity and customer experience of their services.

Open Banking - Enthusiasm here, skepticism there

The banking customer survey also addressed a topic of the future: Open Banking. Financial institutions are opening their infrastructure to third-party offerings, going beyond the requirements of the new EU Payment Services Directive PSD2. In an Open Banking world, customers can access all financial services through a single app. In Germany, this kind of platform strategy is entirely in the customers’ interest: At 66.1%, a large majority of the German millennials would welcome access to all financial information via a single app. In other countries, such as the United Kingdom, the acceptance of Open Banking is at a similarly high level.

In Switzerland, on the other hand, only 41.2% of bank customers surveyed believe that such an app could make their daily lives easier. In Austria, too, the enthusiasm for Open Banking with a value of 41.2% is still relatively low. Reservations about Open Banking are mainly made by Austrian and Swiss banking customers regarding the security of the applications.

Martin Unterbäumen, Vice President Global Product Management at CREALOGIX, says:

"Banks are challenged to take these concerns seriously. Multi-level security strategies with strong customer authentication and fraud prevention measures should be part of every Open Banking initiative."

Once a bank with a digital banking infrastructure and open interfaces (APIs) has created the technical foundation for Open Banking, the financial institution can orchestrate an individualised customer experience with its own apps and third-party applications.

Martin Unterbäumen, Vice President Global Product Management at CREALOGIX, says:

"Against the background of intensifying competition in the banking sector and an increased willingness of customers to change, the creation of a positive customer experience is becoming central for financial institutions. For banks, it is therefore advisable to position themselves early on with Open Banking Services - because first movers have the easiest way to bind customers to to new offerings in an open ecosystem an in the long-term to their institute.”

A survey of 1000 Banking Customers between the ages of 18-45 in Switzerland, Austria and Germany shines a light on Bricks and Mortar, Mobile Banking, the future of Open Banking and lastly, Customer Experience and Satisfaction.