April 18, 2024

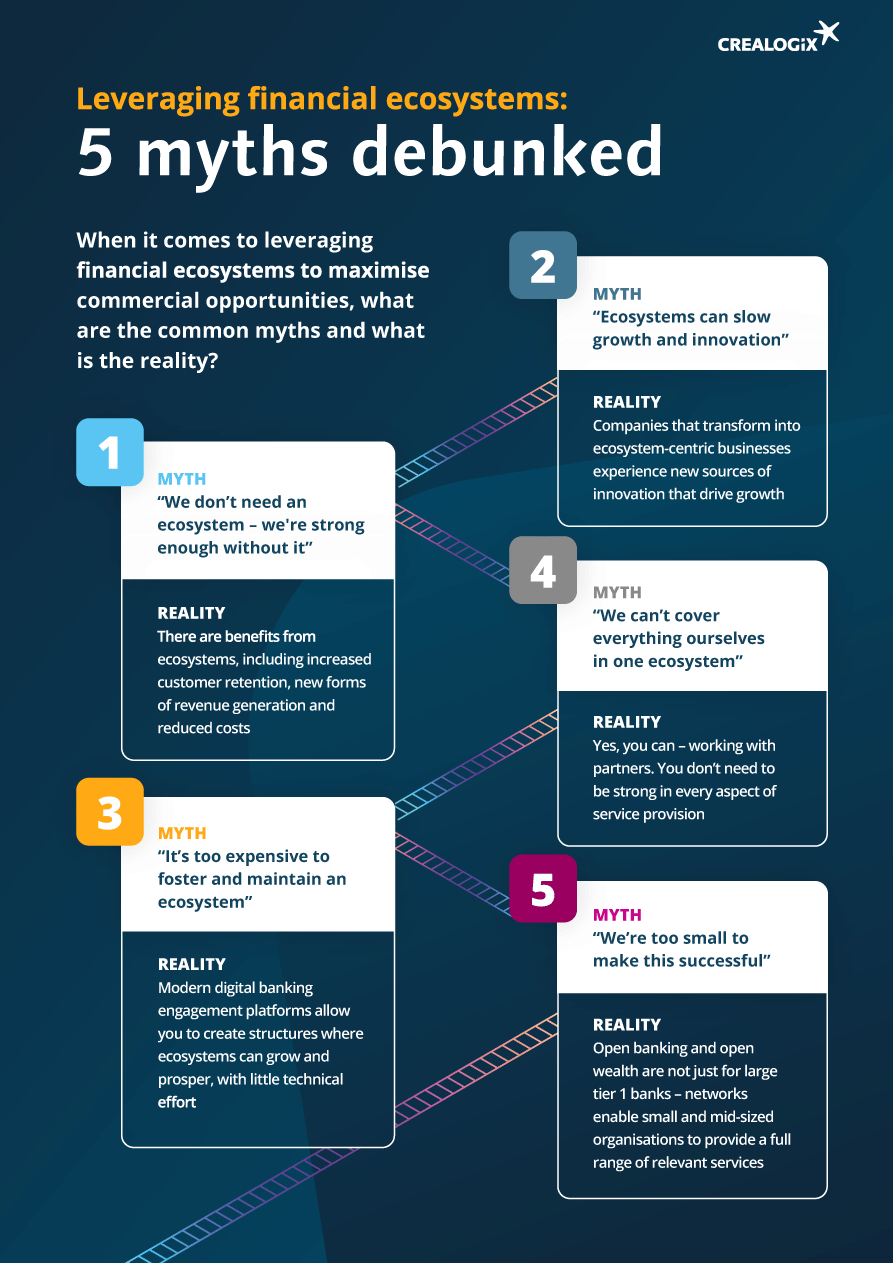

Financial ecosystem: debunking the five biggest myths

Lending Origination

A financial ecosystem provides greater added value to customers. However, there are still some misconceptions about the business model for financial organizations. We took a look at some of the most common myths surrounding the cost and complexity of financial ecosystems:

- "We do not need a financial ecosystem; we are strong enough without."

A financial ecosystem provides multiple benefits for banks and other financial institutions, including increased customer retention, new forms of revenue, and reduced costs. - "Financial ecosystems slow down growth and innovation."

In fact, financial ecosystems can transform companies, enabling new forms of innovation that drive growth.

- "It is too expensive to build and maintain a financial ecosystem."

With little technical effort and modern software solutions for digital banking platforms, you can create structures where a financial ecosystem can grow and prosper.

- "We cannot cover everything ourselves in one financial ecosystem."

You do not have to be strong and knowledgeable in every aspect of service provision since ecosystems are based on the idea of collaborating with partners.

- "We are too small to set up a successful financial ecosystem."

Open banking and open wealth management are not only for large institutions. Networks enable small and medium-sized firms to provide a full range of services.

Addressing the myths surrounding financial ecosystems is just the start. Once you’ve removed the barriers to change and established the possibilities of the financial ecosystem for more customer-centric digital solutions, fintech partners can help you accelerate innovation. Work with us on a solution that addresses customer needs and aligns with your brand and service portfolio.